PROPERTY SEARCH

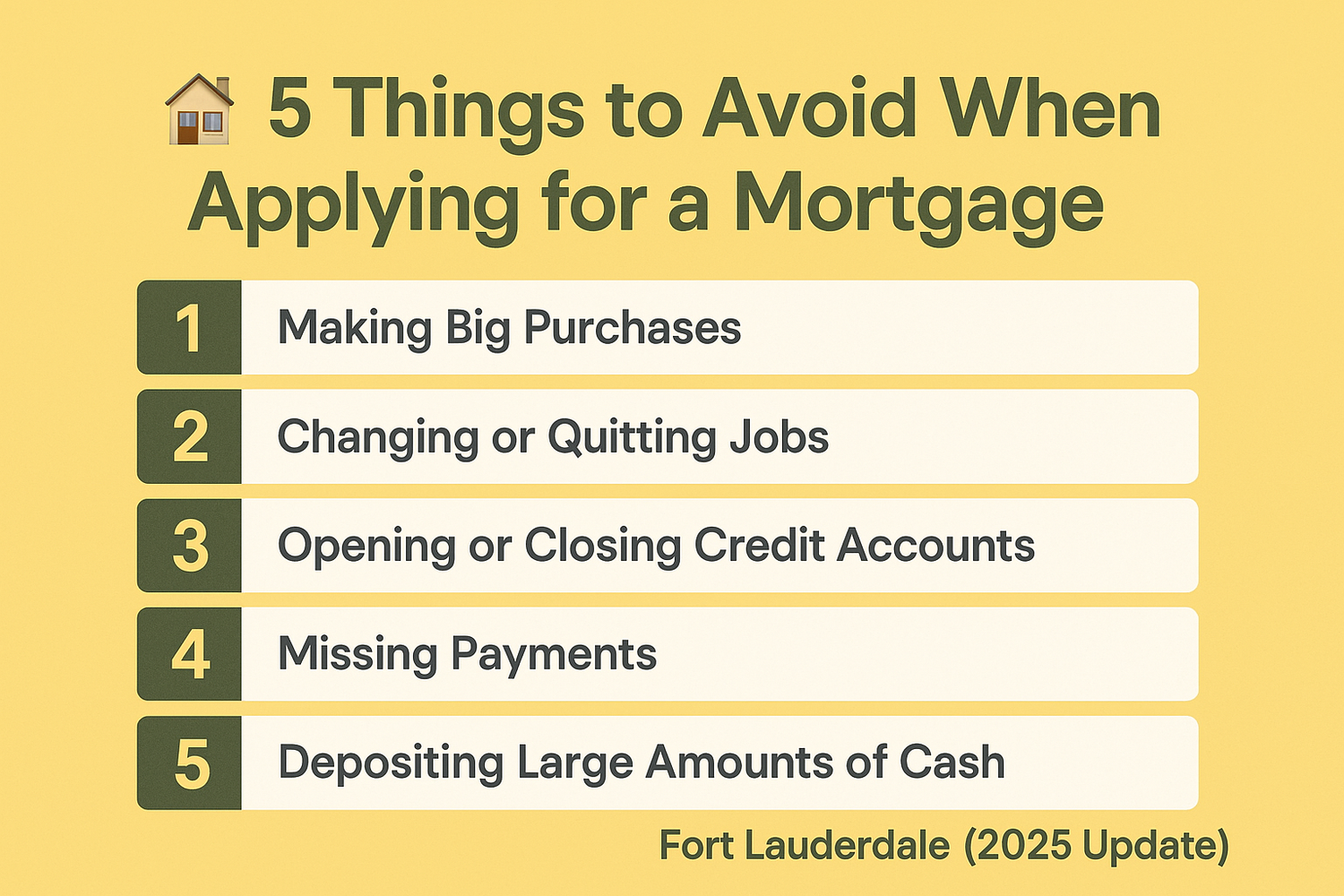

🚫 5 Mortgage Application Mistakes Florida Buyers Should Avoid (2025)

Applying for a mortgage can feel overwhelming, especially when it’s your first time. The truth is, many homebuyers accidentally delay or kill their deal by doing things that lenders don’t like. Here are the top 5 mistakes we see all the time—and how to avoid them:

1. Changing Jobs or Income Sources

Lenders love stability. Switching jobs, quitting, or going self-employed before closing can lead to full re-approval—or worse, denial.

2. Making Large Purchases or Deposits

Buying furniture, transferring money between accounts, or receiving mystery deposits can throw off your debt-to-income ratio. Talk to your lender first.

3. Opening or Closing Credit Accounts

Even if your credit score is high, opening a new line (or closing an old one) impacts your utilization ratio and score. Wait until after closing.

4. Missing Payments

One late credit card or loan payment can tank your approval. Stay on autopay and keep all accounts current while applying.

5. Co-Signing for Someone Else

Even if it’s a family member, co-signing adds their debt to your name. It could push your DTI over the limit, and lenders will see it as a liability.

✅ Want to Avoid These Mistakes?

Let’s work together. Schedule a free consultation or grab your home valuation here if you’re also selling.

We’ve got guides, checklists, and expert contacts ready to help on our downloads page.

📞 Questions? Reach out anytime: scott@reallistingagent.com or call 954-342-6180.